New York City Economic and Fiscal Monitoring

The Office of the State Deputy Comptroller for the City of New York monitors New York City's fiscal condition, assists the New York State Financial Control Board, and regularly reports on the City's financial plans, major budgetary and policy issues; economic and economic development trends, and budgetary and policy issues affecting public authorities in the region, including the Metropolitan Transportation Authority. For questions, contact us at [email protected].

Older Adults in New York City: Demographic and Service Trends

More Older Adults Calling NYC Home Than Ever Before

New York City’s 65 and older population grew by nearly half a million seniors in the last two decades, an increase of 53%. Much of the growth was led by Asian, Hispanic and Black seniors calling the City home, along with more seniors born outside the U.S. The City needs to continue to monitor the trends of the aging population to ensure services remain commensurate with need and outreach is robust.

Read Report

Review of the Financial Plan of the City of New York

Finances Stabilizing, City Should Bolster Reserves

New York City’s finances have stabilized amid declining costs for asylum seekers and strong revenue, largely from growth in business and property tax collections. The City must balance fiscal management with its operational needs to ensure it can continue to encourage employment and business growth, enhancing its economic and tax revenue base.

Read Report

Broadband Availability, Access and Affordability in New York City

One in Four City Households Had No Fixed Broadband Access

One in four New York City households had no cable, FTTP or DSL internet subscription as of 2023, with The Bronx having the highest share of households without access. More than availability, the challenge for residents to access the internet in the City appears to be driven by a lack of affordable options for some.

Read Report

New York City Agency Services Update

DiNapoli Tracks Performance, Recommends Greater Transparency

New York City’s government workforce reached more than 300,000 employees in June of 2024, the first year-over-year increase since the COVID-19 pandemic. Still, some City agencies remain understaffed, resulting in critical services being impacted. The operational complexity in delivering these services highlights the critical need for stakeholders (management and the public) to have access to relevant data to evaluate the performance of a given agency or program.

Read Report

NYC Health + Hospitals

Nurse Staffing Trends Update

New York City Health + Hospitals (H+H) spent $168 million more than projected on temporary staff, despite hiring over 1,660 new nurses in city fiscal year 2024. Nurse employment trends have improved since the end of the public health emergency, especially in New York City and particularly at H+H. In order to manage staffing pressures and service demand, H+H must continue to balance hiring of new staff to execute on its strategic and financial plan.

Read Report

Subway Recovery Tracker

Impact of the COVID-19 Pandemic on Subway Ridership in New York City

The COVID-19 pandemic had a profound and disparate impact on subway ridership in New York City. Initially, the emergence of the virus in March and April 2020 corresponded with a steep and uniform drop in subway usage across all five boroughs. Citywide, April 2020 ridership was just 8.3 percent of what it was in April 2019, and through the summer of 2024 ridership has yet to regularly surpass 70 percent of pre-pandemic levels.

View Dashboard

Financial Outlook for the Metropolitan Transportation Authority

As Funding Uncertainties Linger, Budget Holes Are Opening Up

After a brief period of financial stability secured by an infusion of State funds last year, the Metropolitan Transportation Authority (MTA) now faces growing fiscal uncertainties and risks that create projected budget gaps. Those gaps could grow much wider if various budget risks that the MTA has identified come to pass. A faster-than-expected return of ridership remains one of the key means for improving the fiscal stability of the system and highlighting the importance of continued investment in the assets of the system.

Read Report

Agency Services Monitoring Tool

MONTHLY UPDATES TRACK PERFORMANCE, STAFFING AND SPENDING

The Office of the New York State Comptroller developed a tool that displays performance indicators, staffing levels and spending commitments assigned to a City service since January 2020. While there are many factors that affect service demand and provision, the tool can provide some insight on existing operational or budgetary phenomena or the emergence of potential risks to the City’s budget and the provision of certain services.

View Dashboard

New York City Industry Sector Dashboards

MONTHLY UPDATES TRACK THE CITY’S ECONOMIC RECOVERY

The COVID-19 pandemic hit New York City particularly hard, causing massive job losses at major employers such as restaurants, hotels and retail stores. These dashboards follow a series of reports released over the past two years tracking economic data and the effect of the pandemic on these critical sectors and will help identify areas of weakness as well as positive developments.

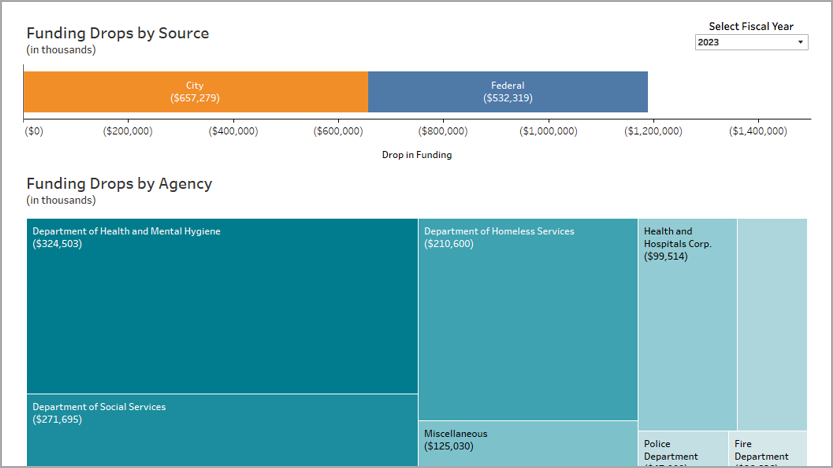

Identifying Fiscal Cliffs in New York City’s Financial Plan

DROP IN FUNDING COULD IMPACT SERVICES FOR RESIDENTS

New York City’s published financial plan includes funding for some recurring spending initiatives for only a limited period, creating additional risks to already identified budget gaps. The Office of the State Comptroller has created a tool to identify sources and uses of funds for City programs that are not fully funded during the remaining years of the City’s financial plan.

View Online Tool