Property tax levy growth will be capped at 2% for 2025 for local governments that operate on a calendar-based fiscal year, according to data released today by State Comptroller Thomas P. DiNapoli. This figure affects tax cap calculations for all counties, towns, and fire districts, as well as 44 cities and 13 villages.

"Allowable tax levy growth will be limited to 2% for a fourth consecutive year," DiNapoli said. “The rate of inflation has decreased since the highs of 2022, but local governments are still facing higher prices for goods and services, moderating sales tax revenue collections, and an end to federal pandemic aid. Local officials should consider these issues as they budget for the coming year.”

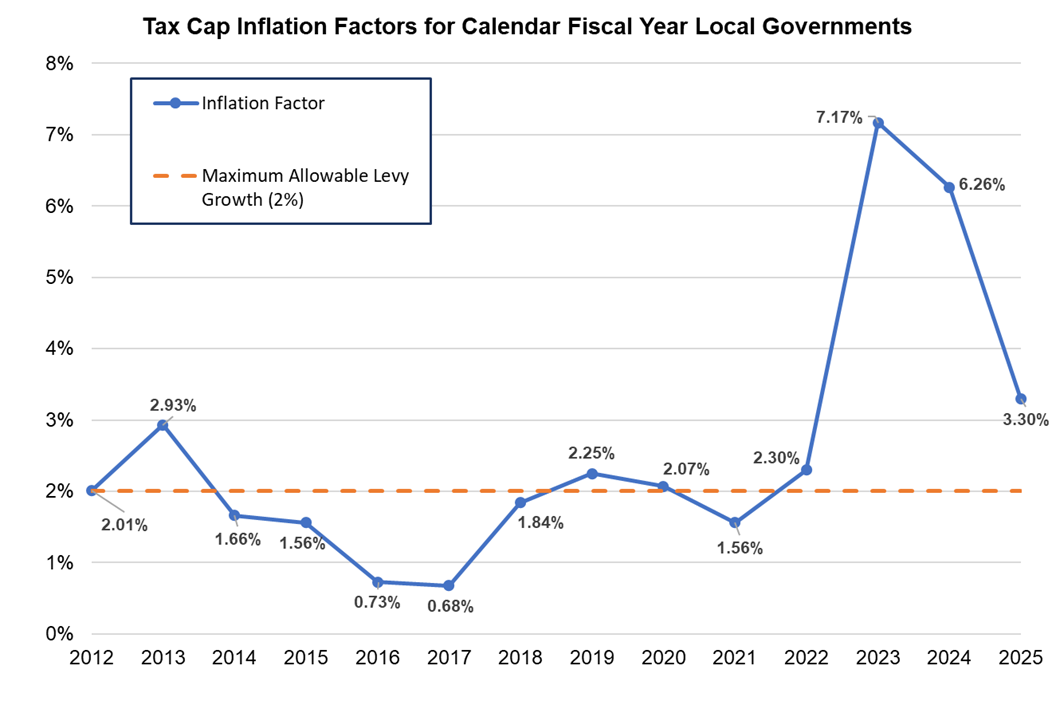

In accordance with state law, DiNapoli’s office calculated the 2025 inflation factor at 3.30% for those local governments with a calendar fiscal year, above the 2% allowable levy increase, and indicative of the higher costs facing these localities.

The tax cap, which first applied to local governments (excluding New York City) and school districts in 2012, limits annual tax levy increases to the lesser of the rate of inflation or 2% with certain exceptions. The law also includes a provision that allows municipalities to override the cap.

Chart

Allowable Tax Levy Growth Factors for Local Governments