In his annual report assessing the proposed Executive Budget, State Comptroller Thomas P. DiNapoli identifies risks and concerns that underscore the importance of taking action to address the trajectory of state spending and improve the state’s structural imbalance, while continuing to bolster the state’s rainy day reserves. Cumulative outyear budget gaps projected by the Division of Budget (DOB) have increased to a total of $27.3 billion through State Fiscal Year (SFY) 2028-29 and state spending is projected to rise at a rate that outpaces revenues.

“Uncertainty over federal funding and the ending of federal pandemic aid creates an urgent need to strengthen the state’s fiscal position,” DiNapoli said. “Federal funding provides the backbone of the safety net and funds for a wide array of essential services including health care, education, transportation and clean water programs. Potential cuts or significant policy changes in Washington may have a large impact on the state’s finances and on New Yorkers’ quality of life. Preserving state services and maintaining long-term budget balance will require a careful examination of the state’s spending trajectory on major programs in ways that do not harm services, but ensures their long-term fiscal viability.”

Spending Growth

DOB projects All Funds spending in SFY 2025-26 to total $252 billion, an increase of $8.6 billion, or 3.6%, compared to updated projections for SFY 2024-25. State Operating Funds (SOF) spending is expected to grow by $10.5 billion, or 7.9%. General Fund (including transfers to other funds) spending is expected to grow by $7.9 billion, or 7.3%.

While General Fund surpluses are anticipated currently for SFY 2024-25 and SFY 2025-26, these are projected to give way to budget gaps that cumulatively total $27.3 billion from SFY 2026-27 through SFY 2028-29. Over the Financial Plan period, General Fund disbursements are projected to grow by 24.9%, over four times as fast as receipts, which are projected to grow 5.3% – twice as much as average annual inflation projected for the period.

Over a 10-year period, from SFY 2018-19 through DOB’s projections for SFY 2028-29, General Fund disbursements are projected to increase by $62.6 billion, or 86%. Similarly, over the 10-year period, SOF spending is projected to increase by $64.5 billion (64.4%). Medicaid is $21.6 billion (33.5%) of this projected increase with School Aid almost $14 billion (21.6%).

The state has struggled to contain Medicaid costs. A significant change in federal policy or an economic shock might result in having to make decisions quickly relating to healthcare funding. Making prudent financial decisions now and putting Medicaid spending growth on a more sustainable path is in the best interests of all New Yorkers.

Similarly, continued efforts are necessary to review the Foundation Aid formula, the largest component of school aid, to allocate resources to districts with the greatest needs while providing stability for school districts planning and ensuring the state’s long-term financial viability.

Federal Funding and Risks

DOB projections for federal receipts reflect the significant decrease of pandemic-related spending (and corresponding federal aid). Since SFY 2020-21, a total of $60.7 billion in pandemic assistance – plus $12.8 billion in state aid from the State and Local Fiscal Recovery Fund – flowed through the Financial Plan, which averages approximately $14.7 billion in each of the past five years.

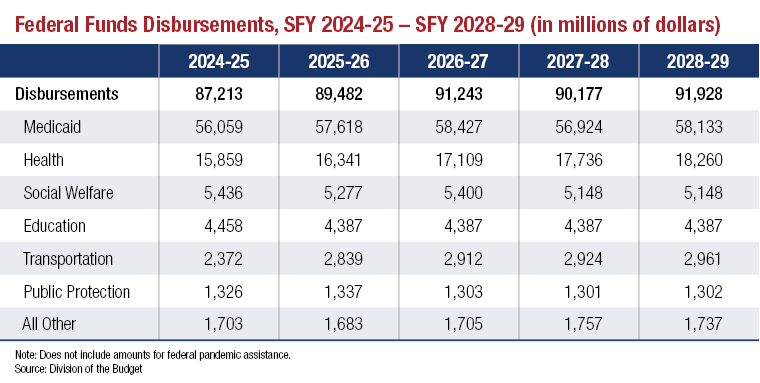

Federal funding is the state’s largest source of revenue. In total, DOB is projecting $93.1 billion in federal receipts for SFY 2025-26. Of this, Medicaid is projected to account for $57.6 billion (61.9%). An additional $13.2 billion is projected for costs related to the Essential Plan (EP), which is a federally subsidized health insurance program authorized under the Affordable Care Act. In total, approximately $70.9 billion (76.1%) of the projected federal receipts are for the provision of healthcare to approximately 8.5 million New Yorkers.

Aside from healthcare, federal aid provides funding for school meals, K-12 education, clean water and drinking water, public assistance (e.g., Temporary Assistance for Needy Families and Home Energy Assistance Program), child and foster care, and grants for transportation and roadways.

The President has issued several executive orders with implications for federal funding. As Congress works on the federal budget, there may be additional and significant changes to law and rules affecting the economy and eligibility and the level of state funding, directly or indirectly, for programs that provide support and assistance to New Yorkers. Any such changes could negatively affect the state’s finances and the finances of New York households.

The Executive Budget does not include any contingency measures for any potentially adverse federal action. In the event of federal cuts, the state may choose to cut programs or services or to increase state-sourced funding to maintain services; however, it does not have the taxing capacity to replace federal spending in total, especially in health and social services. Furthermore, short-term use of reserves cannot solve for a restructuring of the federal-state relationship regarding key programs.

Economic and Revenue Risks

The predominant risks for DOB’s forecast are policies that may be implemented by the new federal administration, including those related to tariffs and the extension of the expiring provisions of the Tax Cuts and Jobs Act, as well as risks from the geopolitical landscape.

On Feb. 1, the Trump Administration announced tariffs on the U.S.’s largest trading partners, Canada, Mexico and China. The proposed tariffs on Canada would be particularly impactful on the state, since it is New York’s top trading partner. In 2023, New York exported $21.7 billion in goods to Canada and imported $22.5 billion. Continued inflation, potentially exacerbated by the impact of these tariffs on the price of goods, could reduce spending power, resulting in lower consumption, the largest component of GDP.

Changes in the labor market as well as the overall population are also a risk to the state’s economy and, in turn, its revenues. According to the most recent U.S. Census estimates, there were over 336,500 fewer people in 2024 than in 2020. Between 2020 and 2024, New York benefitted from the international in-migration of more than 519,000 people, offsetting much steeper losses of domestic out-migration of more than 966,000 people.

Immigration has also been important for sustaining the labor force across the state. Foreign-born New Yorkers are enrolled in higher education at twice the rate of native-born, and are in the labor force and employed at higher rates, as well. Restrictions on immigration may pose challenges for employers, universities seeking students, and communities relying on new residents to remain vibrant.

Competitive Tax Policy

During the pandemic period, the state enacted “temporary” surcharges under both corporate franchise and personal income taxes. While the Executive Budget does not propose extending the higher corporate franchise tax rates, which are to expire at the end of 2026, it includes an extension of the PIT surcharges on high income taxpayers, currently set to expire at the end of 2027, until the end of 2032. This rate extension is channeled into maintaining existing state spending.

While the extent of migration of taxpayers in response to tax changes remains debatable, behavior is less likely to be affected by temporary changes than permanent ones. An early extension of what was supposed to be a temporary surcharge, solidifying high tax rates for another seven years, may alter some decision making. The impact of state policy decisions on taxpayers may also be affected by imminent federal tax changes.

Reserves

DOB’s Financial Plan indicates the state will deposit or transfer a total of $2.5 billion into the statutorily rainy day reserve funds to bring the combined total to $8.8 billion in SFY 2024-25. This will consist of a $1.5 billion deposit and a shift of $1 billion from the “economic uncertainties” unrestricted reserve into the Rainy Day Reserve Fund (RDRF). At the current level, statutory rainy day reserves, both in dollar amounts and as a share of spending, are the highest the state has ever amassed, a welcome reversal of decades of their underfunding. In addition, DOB plans to continue shifting funds from the unrestricted “economic uncertainties” reserve into the RDRF over the subsequent three state fiscal years: $1 billion in SFY 2025-26, $1 billion in SFY 2026-27, and $862 million in SFY 2027-28, as fiscal conditions permit.

Presuming all these deposits are made, statutory rainy day reserves will be a little over $11.6 billion with unrestricted reserves of $9.5 billion by SFY 2027-28, The planned shift to greater reliance on statutory reserves over the course of the Financial Plan is something State Comptroller DiNapoli has repeatedly recommended to guard the funds against premature or inappropriate use. Further improvements could include employing a more consistent approach by making monthly deposits to the statutory rainy day reserves, instead of waiting for fiscal year end, and further increasing resources beyond what the Financial Plan currently anticipates.

Transparency and Oversight

The Executive Budget includes several problematic provisions that, in the aggregate, exempt a minimum of $500 million from the Office of the State Comptroller oversight and the state’s competitive procurement process. There is also an additional $2.8 billion that would be distributed based on a plan that DOB approves but does not require a competitive process or objective criteria. These proposed changes reduce transparency, competition, and State Comptroller oversight over a significant amount of state spending.

Report

Report on the State Fiscal Year 2025-26 Executive Budget

Related Reports

A Roadmap for Debt Reform