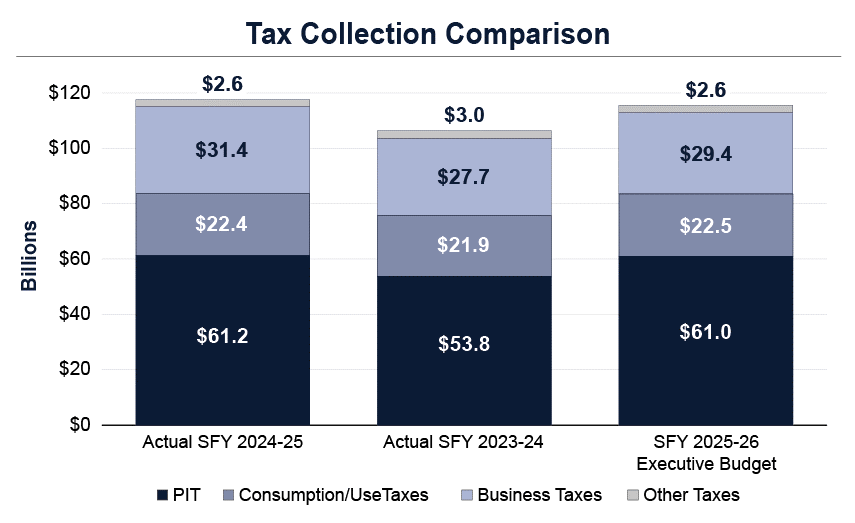

Tax collections for State Fiscal Year (SFY) 2024-25 totaled $117.5 billion, $2.1 billion higher than forecast by the Division of the Budget (DOB) in the SFY 2025-26 Executive Budget Financial Plan, according to the March State Cash Report released by New York State Comptroller Thomas P. DiNapoli.

Tax collections for SFY 2024-25 were $11.1 billion (10.4%) higher than the previous year, due, in part, to increased personal income tax (PIT) receipts resulting from financial market growth from calendar year 2024 which propelled bonuses paid in the final quarter of the fiscal year.

“With the steady pace of economic growth and strong financial markets in 2024, the state’s tax collections outpaced forecasts for the year,” DiNapoli said. “However, policy decisions at the federal level, such as tariffs and federal aid cuts, are currently causing economic uncertainty. While the actual impact of these policies is unknown, the heightened risks they pose should be considered as the enacted budget for SFY 2025-26 is finalized.”

Personal income tax (PIT) collections totaled $61.2 billion, $7.4 billion (13.7%) higher than prior year collections. The increase was primarily attributable to stronger withholding and quarterly estimated tax payments associated with the 2024 tax year. PIT collections exceeded Executive Budget Financial Plan projections by $238.8 million.

Consumption and use taxes, which include sales tax, totaled $22.4 billion, exceeding the prior year total by $484.4 million, or 2.2%. These collections were $139 million lower than DOB’s latest projections.

Business tax collections totaled $31.4 billion which was $3.7 billion (13.3%) higher than the previous year, primarily reflecting a $3.8 billion increase in Pass Through Entity Tax receipts due, in part, to an increase in participating businesses compared to last year. Total business tax collections exceeded DOB’s latest projections by $2 billion.

All Funds spending totaled $241.5 billion, which was $6.6 billion or 2.8%, higher than last year. The General Fund ended the fiscal year with a balance of $56.9 billion, an increase of $10.6 billion from the opening balance.

Major actions taken by DOB at the end of the fiscal year include:

- $2.8 billion in debt service pre-payments.

- The deferment of nearly $1.367 billion in state-share Medicaid provider payments from March to April, continuing a multi-year pattern.

Report

March Cash Report