Economic and Policy Insights

Small Businesses and the Economic Recovery: Work in Progress

November 23, 2021

Businesses in New York were more severely impacted by the COVID-19 pandemic in the spring of 2020 than in the rest of the nation, and the negative impacts on small businesses with less than 500 employees persist. In addition, small businesses report facing new challenges with hiring difficulties and with supply chains. Nevertheless, one in five small businesses reported a return to normal operations in October 2021, there have been significant improvements in several sectors, and applications for new businesses are surging, which bodes well for the economic recovery. Funding from State grant programs has also begun to flow, and expeditiously disbursing these funds remains critical to helping New York’s small businesses continue to recover.

Challenges Confronted by Small Businesses in the Economic Recovery

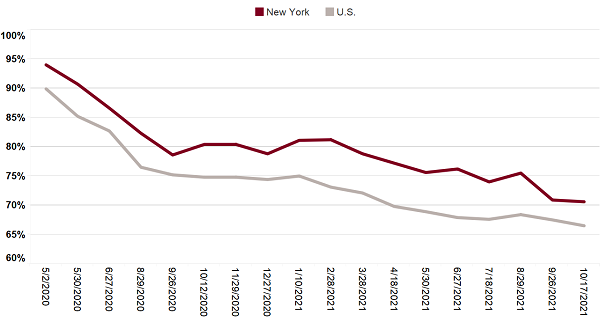

Since the U.S. Census Bureau began collecting and reporting data through the Small Business Pulse Survey, New York’s small businesses have consistently reported experiencing a negative effect from the pandemic at rates that exceed the national average, as shown in Figure 1. Conditions have improved by the same margin (23 percentage points) in New York and nationally, with 71 percent of small businesses in New York and 67 percent nationally reporting a negative effect from the pandemic as of the week ending October 17, 2021 (also referred to as October 2021), the most recent week for which data are available.

FIGURE 1 – Share of Small Businesses Reporting Negative Effect from COVID-19 Pandemic, New York vs. U.S., May 2020–October 2021

Source: U.S. Census Bureau, Small Business Pulse Survey

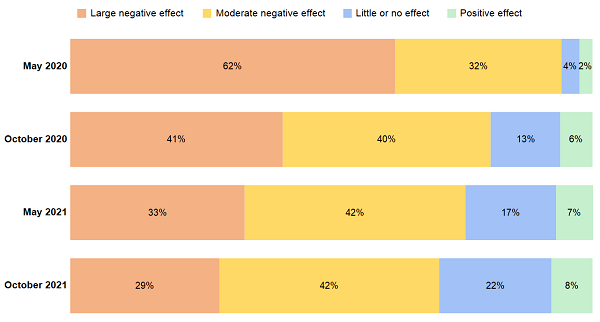

As the economy reopened and began its recovery, small businesses in New York reported experiencing less severe effects from the pandemic than they did a year ago. As of October 17, 2021, 29 percent of small businesses reported large negative effects from the pandemic — a decrease of 12 percentage points from October 12, 2020 (also referred to as October 2020). (See Figure 2.) In fact, 30 percent of small businesses surveyed reported little to no effect or even a positive effect from the pandemic. One in five small businesses also reported a return to “normal operations.”

FIGURE 2 – Overall Effect from COVID-19 Pandemic as Reported by New York Small Businesses, May and October, 2020 and 2021

Source: U.S. Census Bureau, Small Business Pulse Survey

Another positive trend is that fewer small businesses are reporting decreases in week-to-week revenues: 23 percent in October 2021, compared to 31 percent in October 2020. (See Figure 3.) Similarly, only about 1 in 12 reported declines in people employed from the prior week, down from 1 in 10 a year ago. However, about 32 percent of small businesses continued to report personnel levels that are lower than pre-pandemic levels, and about 29 percent reported difficulty hiring in October 2021, rates that are similar to the national average.

FIGURE 3 – Share of New York Small Businesses Surveyed Reporting Declines in Weekly Revenue and Employees, May 2020, October 2020, and October 2021

| May 2020 | October 2020 | October 2021 | |

|---|---|---|---|

| Decline in Revenue | 77% | 31% | 23% |

| Decline in Employees | 35% | 10% | 8% |

Source: U.S. Census Bureau, Small Business Pulse Survey

Another challenge is that a growing share of small businesses in New York have reported supply chain difficulties. In October 2021, the Pulse Survey found that 46 percent of New York small businesses reported encountering at least one problem, a 16 percentage point increase from last year. Two-thirds of small businesses reported supplier delays, and one-third reported difficulty locating alternate suppliers. Lastly, one out of every four businesses identified delivery delays as a problem. Given these challenges, 57 percent of small businesses reported supplier delays, and 27 percent reported difficulty locating alternate suppliers.

Small Business Impacts by Industry

Small businesses account for the overwhelming majority of firms in most industry sectors in New York.1 According to the U.S. Census Bureau’s Annual Business Survey, they also employ the majority of workers in industry sectors such as accommodation and food services; wholesale trade; real estate; construction; professional, scientific and technical services; and arts, entertainment and recreation.

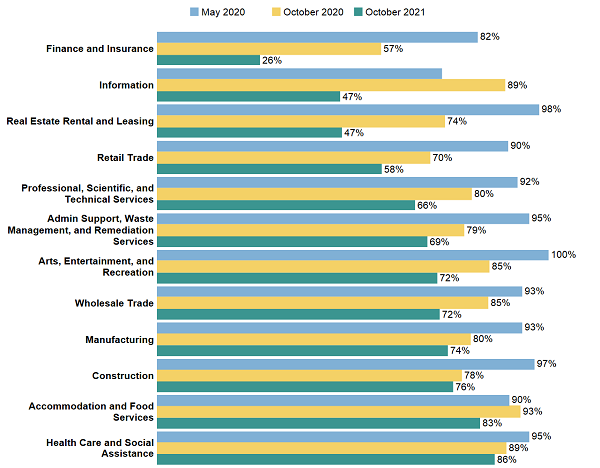

According to the Pulse Survey, while small businesses in all sectors in New York reported negative effects from the pandemic in May 2020, the persistence of those impacts has varied significantly by industry, as shown in Figure 4. In two sectors — accommodations and food service, and health care and social assistance — more than 80 percent of small businesses surveyed continued to report negative effects in October 2021. In contrast, the share of small businesses in finance and insurance reporting negative impacts decreased significantly and is now the lowest among the sectors, at 26 percent in October 2021. The shares of small businesses in the real estate and information industries reporting negative impacts were also significantly reduced between May 2020 and October 2021.

FIGURE 4 – Share of New York Small Businesses Surveyed Reporting Negative Impact by Industry Sector, May 2020, October 2020 and October 2021

Source: U.S. Census Bureau, Small Business Pulse Survey

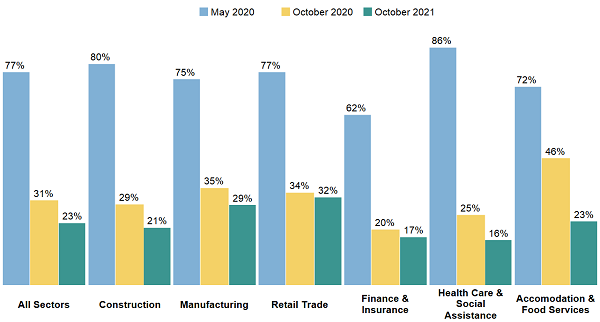

Small businesses also experienced differential impacts on revenues depending on the sector, as shown in Figure 5. Those in the construction (80 percent) and health care and social assistance (86 percent) sectors reported rates of revenue decline in May 2020 that exceeded the statewide average (77 percent); however, the shares of small businesses reporting declines from the prior week have decreased steadily since that time, reaching 16 percent in the health care and social assistance sector and 21 percent in construction in October 2021. On the other hand, firms in the manufacturing and retail trade sectors report higher rates than the statewide average (23 percent) at 29 percent and 32 percent, respectively.

FIGURE 5 – Share of New York Small Businesses by Industry Sector Reporting a Decrease in Revenue from the Previous Week, May 2020, October 2020 and October 2021

Source: U.S. Census Bureau, Small Business Pulse Survey

Future Prospects for Small Businesses

Over the two decades before the start of the COVID-19 pandemic, small businesses demonstrated robust growth in the New York economy. Between 1999 and 2019, the number of small businesses grew by 12.1 percent or 43,510 firms, with the number of employees rising by almost 473,000 or 13 percent. (See Figure 6.) While employment grew more rapidly at large businesses, small businesses constituted 98 percent of growth in the number of all New York firms during this period, with most of these new businesses (38,860 or 89 percent) employing fewer than 20 people.

FIGURE 6 – Growth in New York Businesses, 1999–2019

| 1999 | 2019 | 20-Year Change | Percentage Change | |||||

| Number of Firms | Number of Employees | Number of Firms | Number of Employees | Number of Firms | Number of Employees | Number of Firms | Number of Employees | |

| 1 to 19 employees | 320,698 | 1,444,636 | 359,558 | 1,560,283 | 38,860 | 115,647 | 12.1% | 8.0% |

| 20 to 499 employees | 37,971 | 2,250,123 | 42,621 | 2,607,437 | 4,650 | 357,314 | 12.2% | 15.9% |

| Total Small Businesses | 358,669 | 3,694,759 | 402,179 | 4,167,720 | 43,510 | 472,961 | 12.1% | 12.8% |

| 500 employees or more | 4,107 | 3,345,223 | 4,854 | 4,332,221 | 747 | 986,998 | 18.2% | 29.5% |

| All Businesses | 362,776 | 7,039,982 | 407,033 | 8,499,941 | 44,257 | 1,459,959 | 12.2% | 20.7% |

Source: U.S. Census Bureau, Business Dynamics Statistics

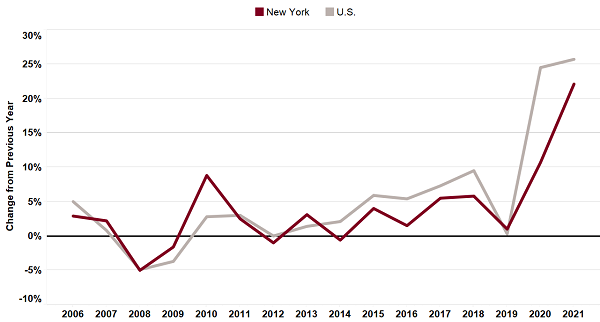

Since 2019, a record number of applications for new businesses have been submitted in New York and nationally. From 2019 to 2020, the average monthly number of new business applications increased by 10.7 percent in New York State and by 24.5 percent nationally and from 2020 to 2021, applications accelerated, increasing by 22.1 percent, closer to the national figure of 25.7 percent. (See Figure 7.) Even as many small businesses shuttered their doors and others have continued to struggle, entrepreneurs are identifying and pursuing new opportunities.

FIGURE 7 – Year-Over-Year Change in Monthly Average Business Applications, New York vs. U.S., 2006–2021

Source: U.S. Census Bureau, Business Formation Statistics

In addition to the federal assistance available through programs like the Paycheck Protection Program, leaders in New York also dedicated significant State funding to small business recovery. The Enacted Budget for State Fiscal Year (SFY) 2021-22 included $1.6 billion in new State and federal funding for a variety of programs, including:

- $600 million in federal funds for the State Small Business Credit Initiative (SSBCI) to fund small business credit support and investment programs.

- $800 million in State funds for a new COVID-19 Pandemic Small Business Recovery Grant Program to support small businesses that do not qualify for relief under the federal SSBCI or other business assistance programs.

- $25 million in State funds for the New York Restaurant Resiliency Grant Program to provide grants to restaurants that offer meals or food to people within distressed or underrepresented communities.

- $40 million in State funds for grants to support the operations of cultural nonprofit organizations that have been impacted by the COVID-19 pandemic.

- $135 million of Pandemic Recovery and Restart program tax credits from the State are also available for music and theatrical production companies in New York City, and restaurants statewide.

Of the $865 million in State grant funding that was appropriated in the SFY 2021-22 State Budget, $415.3 million (48 percent) has been spent. Expediting the allocation of small business recovery funding is essential to mitigating the continued impacts of the pandemic on small businesses and to advancing New York’s recovery. According to information from the Office of the State Comptroller’s COVID-19 Relief Program Tracker, as of October 31, 2021, none of the $600 million in federal funds for the SSBCI have been received or disbursed.

Endnote

1 Small businesses account for about 66 percent of firms in the utilities sector and about 35 percent in the management of companies sector. For more details on small businesses in New York State, see Office of the New York State Comptroller's report, “Small Business in New York State: An Economic Snapshot.”