Purpose:

The purpose of this bulletin is to inform agencies of the processing requirements for employees who claim exempt from Federal, State, and/or Local tax withholding in tax year 2025.

Affected Employees:

Employees who claimed exempt from Federal, State, and/or Local tax withholding in 2024 and employees who submit withholding certificates claiming exempt in 2025 are affected.

Background:

According to IRS Publication 505 (Tax Withholding and Estimated Tax) and IRS Instructions for Form W-4 (Employees Withholding Certificate), employees who claimed exempt from Federal withholding for tax year 2024 and intend to claim exemption in 2025 must file a new Form W-4 by February 15, 2025, to claim exemption for tax year 2025.

The New York State Department of Taxation and Finance requires form IT-2104-E (Certificate of Exemption from Withholding) to be filed annually by employees who claim exempt from New York State, New York City, or Yonkers withholding.

Effective Dates:

Effective as of Administration paycheck dated February 26, 2025, and Institution paycheck dated March 6, 2025.

Agency Actions:

The following Control-D report is available for agency use.

NPAY738 - Employees Exempt from State and Federal Taxes

This report identifies employees who claimed exempt from Federal, State, and/or Local tax withholding for tax year 2024.

Agencies must review the NPAY738 Control-D report and request a new Form W-4 and/or IT-2104-E from all employees appearing on the report.

If the employee does provide new form(s), agencies must update the employee’s Federal, State, and/or Local Tax Data pages as follows:

- Employee Main Menu>Payroll for North America>Employee Pay Data USA>Tax Information>Update Employee Tax Data.

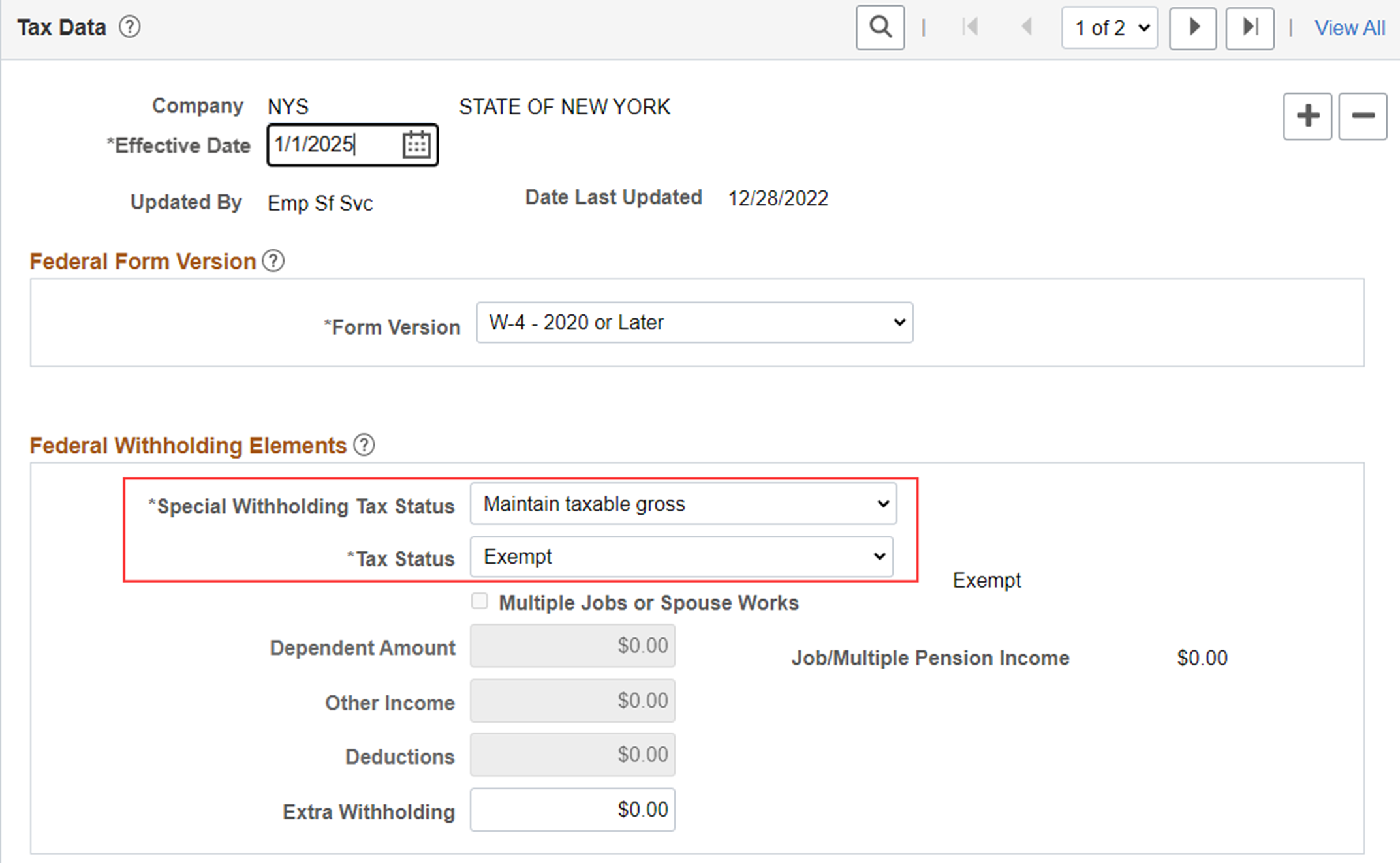

- Select the Federal Tax Data page.

- Insert a new row with a valid effective date for 2025.

- Federal Form W-4 Version should be set to “2020 or Later”.

- Under the Special Withholding Tax Status select “Maintain taxable gross”.

- Set the Tax Status to “Exempt.”

- All other fields should be “0” or blank (see screen shot below).

- Save the page.

- Navigate to the State and Local Tax Data pages with the same effective date as above and update the Special Withholding Tax Status to “Maintain taxable gross”.

If an employee appearing on the report does not provide a new Form W-4, begin withholding as if the employee had checked the box for Single or Married filing separately in Step 1 (c) and made no entries in Step 2, Step 3, or Step 4 of the 2020 or later Form W-4. The agency must update the employee’s Federal Tax Data page as follows:

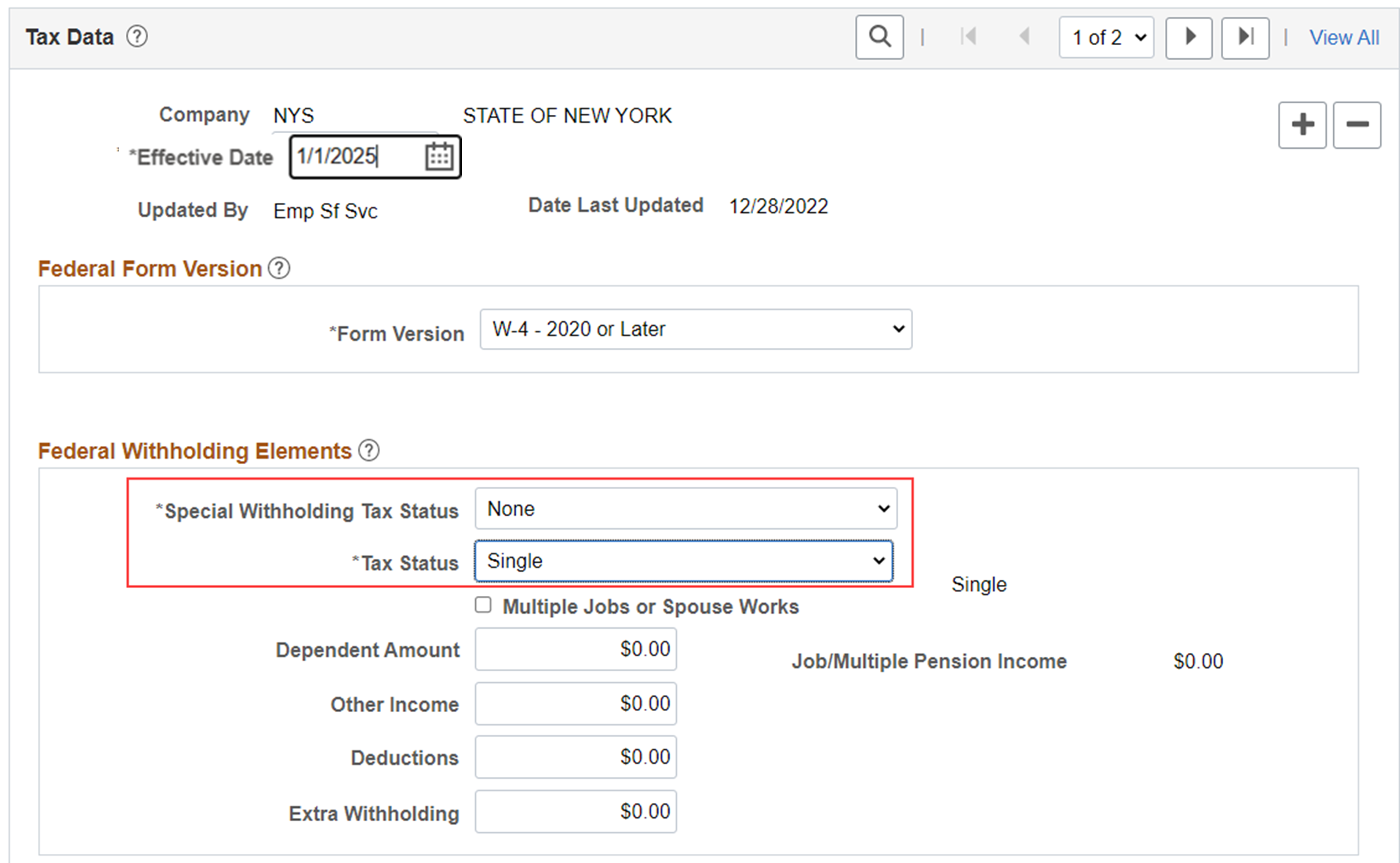

- Main Menu>Payroll for North America>Employee Pay Data USA>Tax Information>Update Employee Tax Data.

- Select the Federal Tax Data page.

- Insert a new row with a valid effective date for 2025.

- Federal Form W-4 Version should be set to “2020 or Later”.

- Under the Special Withholding Tax Status, select “None.”

- Set the Tax Status to “Single.”

- All other subsequent fields should be “0” or blank (see screen shot below)

- Save the page

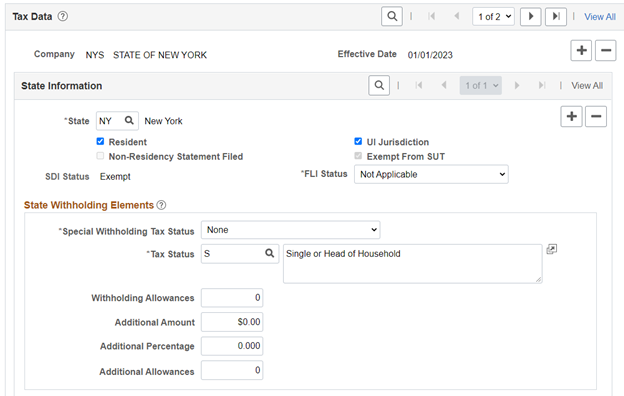

If the employee has also not submitted the IT 2104-E, update the employee’s State and Local Tax Data pages as follows:

- Navigate to the State Tax Data page with the same effective date as above.

- Under the Special Withholding Tax Status, select “None”

- Set the Tax Marital Status to “Single”

- All other subsequent fields should be set to “0” (see screen shot below).

- These same selections should be made to the Local Tax Data page, if applicable.

- Save page.

Questions:

Questions regarding this bulletin may be emailed to the Tax and Compliance mailbox.