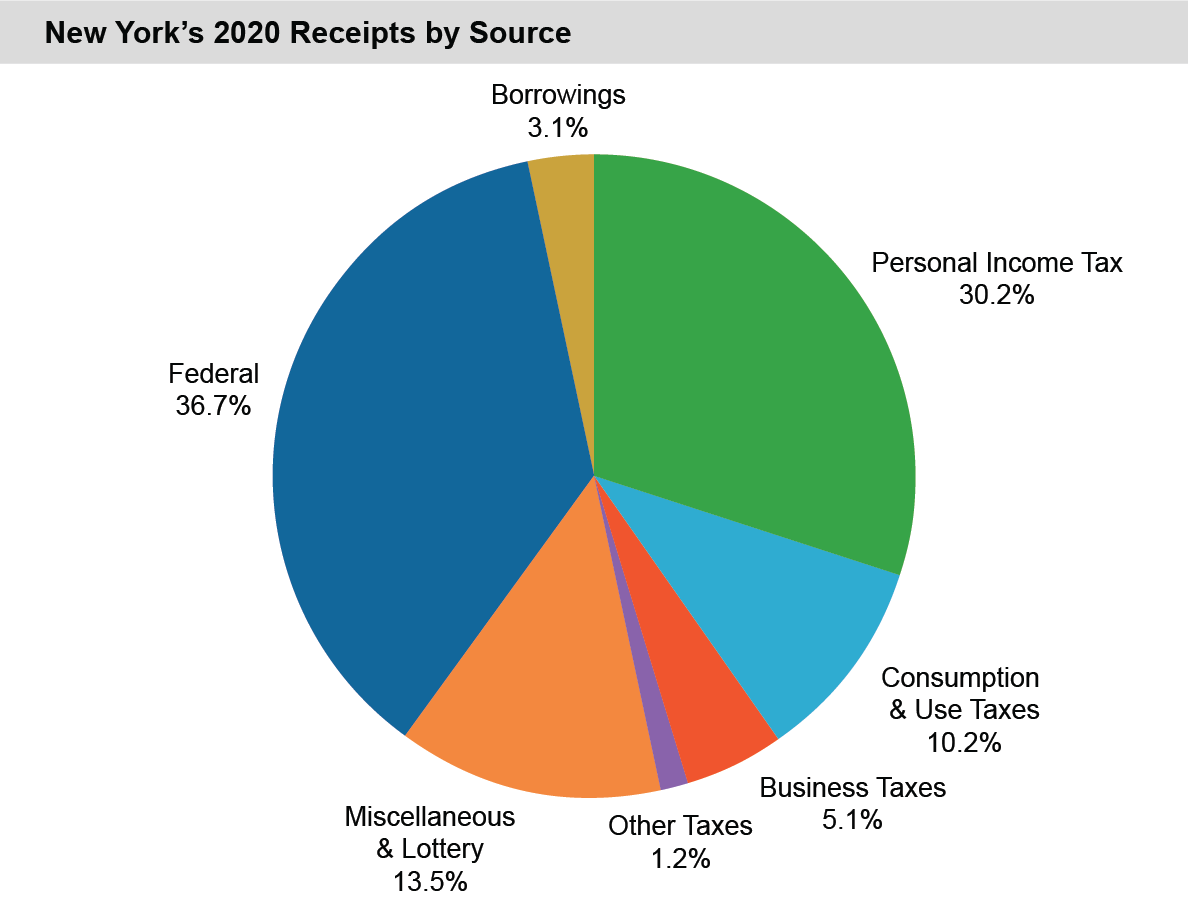

Revenues are affected by economic changes as well as changes in federal and State policies. Tax base is a measure of the State’s ability to generate revenue. A decreasing tax base may force spending reductions, increased taxes, or both. Receipts are revenues that have been recorded on a cash basis.

See Appendix 3 for a breakdown of State receipts by major source for the past five State fiscal years.

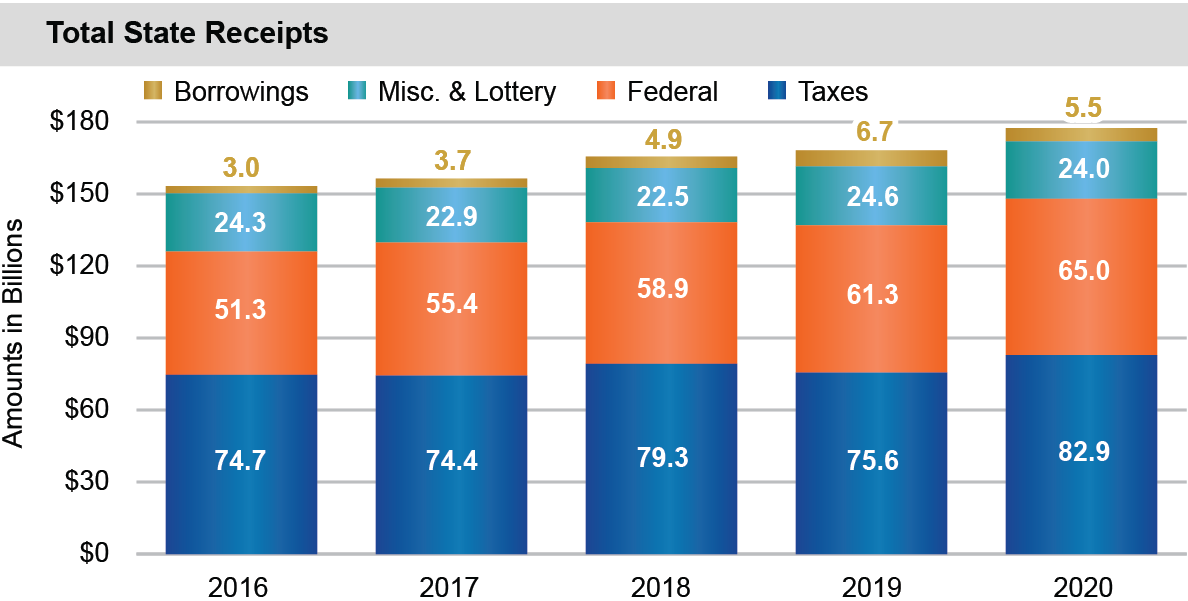

Total State Receipts Have Increased Over the Past Five Fiscal Years

- From 2016 to 2020:

- Total receipts increased 15.8 percent.

- Tax receipts increased 11.0 percent.

- Federal receipts increased 26.8 percent.

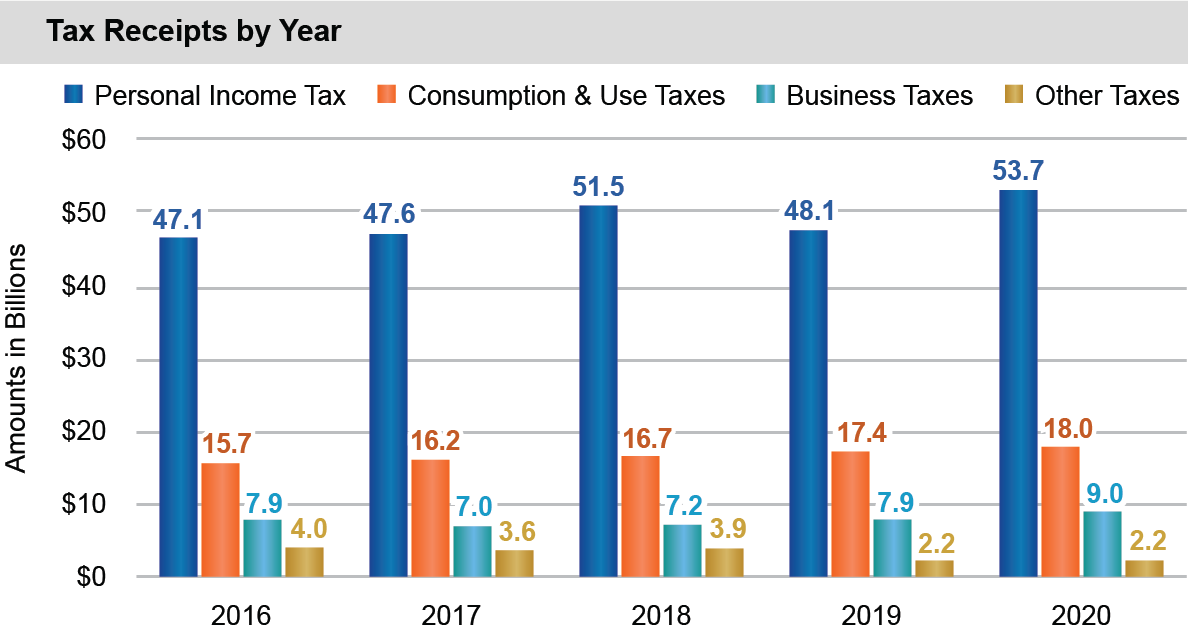

Personal Income Tax and Consumer Tax Receipts Have Increased Over the Past Five Fiscal Years

- Personal income tax and consumer (consumption and use) taxes:

- Accounted for 40.4 percent of 2020 receipts; and

- Have increased 14.2 percent since 2016.

- In 2020, personal income tax receipts—the State’s largest tax revenue source—increased 11.6 percent from the previous year. The increase is partially due to behavioral responses to changes in the Internal Revenue Code resulting from the Tax Cuts and Jobs Act for both the 2017 and 2018 tax years.